Whipsawed in the ER2

QN/ER2

Background:

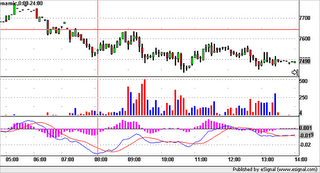

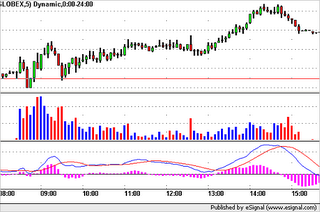

This was the first day trading ER2. Note trading was on Monday November 6th, after the jobs report on Friday and the midterm elections on Tuesday. The main point to note is the whipsaw that took place at the open of the market in the ER2. Initially MACD showed a buy signal and almost immediately flipped around gave a sell signal. The rest of the day was fairly one directional.

Trades:

Unfortunately I only really made 2 trades of any signficance. I was excited about the ER2 and bought when the MACD said to buy, stopping out using the 1 minute chart, and sold when the MACD said to sell, stopping out again on the 1 mintue chart. Because of this I was limit down 3% in the first 30 minutes and had to stop trading for the day.

Negatives:

Well aside from the fact that I went limit down, the risk involved in using the MACD became apparent. However it is interesting to note that the MACD line always said buy and had been indicating buy all night long and into the previous day. The MACD line above or below the center has MUCH more significance than the histogram.

Positives:

This was my first time, all alone I had to stop myself out. It's a difficult task telling yourself that you can no longer trade for the day but I did it successfully and not only that felt really good that I did. Even though the rest of the day could have shown signs of success, it felt good to see I had the discipline necessary to be my own risk manager. In addition to the good discipline I saw the downside to the strategy I was running and will be much more wary on buying or selling based on the MACD histogram.

Conclusion:

Tommorow continue to trade confidently, but lower the contract size in the Russell. Stick mainly to Natural Gas and try not to trade the russell until after it has picked a directional move. Typically 30 minutes is probably the amount of time necessary to slow down the initial volatility, thus drastically reducing the risk of a whipsaw.

Kind of interesting after I posted a quote about how one should not stick to blindly to structure and rigid rules, I saw the reason why.

Good luck and namaste

0 Comments:

Post a Comment

<< Home