Final Trading Plan

Alright...Good luck and Namaste

Trading Plan

Initially Trading the Russell 2000 Index Futures at the CME and MiNY Natural Gas at the NYMEX. This trading plan is created to be applicable to any futures contract. The idea eventually would be to diversify in order to pick up large trends in any market.

Rules:

1

Never break the risk management or position sizing rules. All other rules are subject to change by the trader at any time if he feels that it will increase the possible reward or decrease the possible risk

2

Only trade in markets that are liquid enough to allow for complete execution of a trade with no slippage. I.E. if trading 100 lots miNY natural gas would not be a good option but e-mini S&P might.

3

Never let your emotions change a trade and always have confidence in the system.

4

At most risk 1% per trade and 3% per day.

5

Use position and risk management to always be in multiple contracts at a time so that if the question of taking profits or letting winners run arises then some of the position can be taken off as a precaution

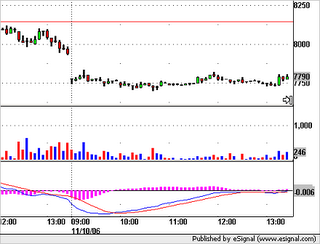

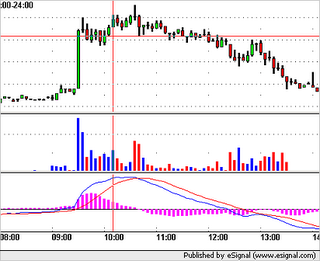

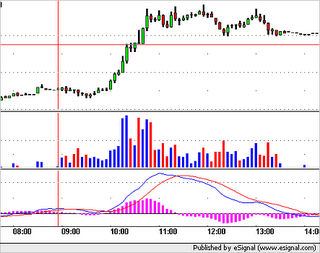

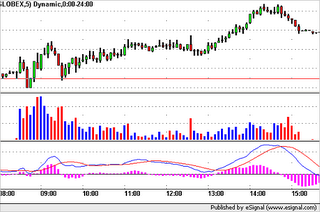

Strategy 1

MACD entry for trend following.

Setup:

During intraday trading, the 5 minute MACD crosses the centerline (MACD goes positive or negative)

The ADX is greater than 20

The 1 minute MACD Histogram is the same sign as the MACD

Risk Management:

Determine the 10 period moving average of the Average True Range of the contract on the 5 minute chart. Use this as your stop position. Then using this determine the number of contracts to use that would allow a worst case scenario between 0.6% and 1.0% of the total capital. Given this information and assuming that this strategy picks trends approximately 33% of the time, use your daily goal profit, as determined by your yearly goal profit, to establish a goal profit on the trade. Only after this value has been reached can the possibility of taking profits be considered.

Execution:

If the setup and risk management have been determined and the trade feels like there is no reason to defer the trade, execute immediately at the market the number of contracts predetermined and place the stop loss physically in the market. The trade should be long if the MACD is positive short if the MACD is negative.

Exit:

If the MACD on the 5 minute crosses the centerline again, thus beginning the setup for the opposite position the trade should be exited. In addition, if the end of the trading day is imminint the trade should again me exited. Othewise, the stop placed in the market should be trailed (trailing only on positive moves**) and kept within a distance of the market determined by three times the 10 period Average True Range.

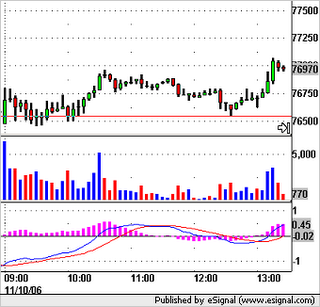

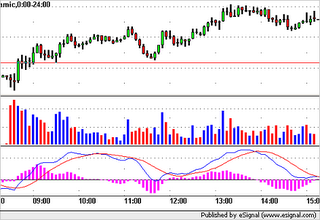

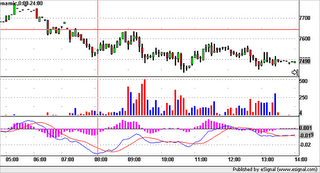

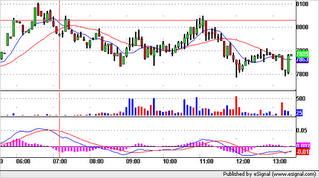

Strategy 2

Stochastic entry for consolidating markets

Setup:

Strategy 1 must not be currently in a trade and the setup for Strategy 1 must not be ready

The ADX is less than 20

The 3 period moving average of the 14 period stochastic indicator on the 1 minute chart must be crossing from above 80 to below or below 20 to above.

Risk Management:

Determine the 10 period moving average of the Average True Range of the contract on the 1 minute chart. Use this as your stop position. Then using this determine the number of contracts to use that would allow a worst case scenario between 0.25% and 0.33% of the total capital. Given this information and assuming that this strategy picks trends approximately 50% of the time, use your daily goal profit, as determined by your yearly goal profit, to establish a goal profit on the trade. Only after this value has been reached can the possibility of taking profits be considered.

Execution:

If the setup and risk management have been determined and the trade feels like there is no reason to defer the trade, execute immediately at the market the number of contracts predetermined and place the stop loss physically in the market. The trade should be long if the Stochastic line crosses from below 20 to above, and short if the Stochastic line crosses from above 80 to below.

Exit:

If the 3 period moving average of the 14 period stochastic indicator on the 1 minute chart now is indicating the opposite trade exit the position. Also any trade should be exited by the end of the trading day. Otherwise exit the trade using a trailing stop kept a distance of 3 times the 10 period moving average of the Average True Range that moves only on postive moves*

**Positive Move

The move in the market must be one that increases the value of the position. I.E. The market goes up if the trade is long, down if short.