Election Day

QN/ER2

Background:

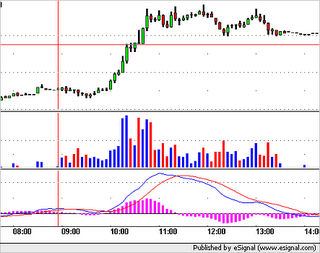

Today is the day of the midterm elections. There shouldn't be much affecting the market until tommorow, but it had the potential for increased volatility in the equity markets. Natty gas started out real slow today with VERY little volume. About mid morning it made a 50 cent up move without looking back. It was marked by HUGE buying volume. After that hour or so it pretty much settle up for the rest of the day though. The ER2, started with a tiny whipsaw and then shot for the moon going up almost 12 points during the morning. There was some slow pull back and then a market break before the close giving up all but 1 point of the rally. Volatility was much higher in both contracts today compared to yesterday.

Trades:

Trades before 6:30 have not been winners so I'm going to stop trading before then and simply trade when there is more volume. As the market started to open I was down in the qn's because of morning trades. I let the Russell figure out what it was going to do (about 30 minutes after the open it picks a direction). It was going up and I got long just one contract. Every 15 ticks positive I'd add one more contract and move my stop up 5 ticks behind the market. I eventually stopped out up just under 2% bucks (not bad for a one lot trade). I stopped out on a few more 2 lot trades during the consolidation period and it came back to 1%. I got in long at the bottom of the natty gas move with a 4 lot I believe, I took of 1 contract at a time as it found levels of resistance and added some back on when it showed renewed signs of life. I eventually went up about 2.5% for a winning day over 3%.

Negatives: Due to yesterday's whipsaw I used VERY small contract sizes because my confidence had been affected and I wanted to trade comfortably. If I had been using my previous contract sizes i would have seriously raked in. I missed out on the last break in the ER2, because I didn't trust the MACD in that contract. However had I followed it and stuck with the trade it would have proved to be a big winner. I also became very tired at the end of the day because of how early I started and wasn't able to trade through the close because my concentration was falling.

Positives: This made up for the loss yesterday and put me sligthly positive for the week. I am still down since starting but I am certainly showing signs of improvement. Asside from the good pnl, I had AWESOME risk reward today. I was catching 25 r winners (which means for every 1 dollar of risk I make 25). That's amazing and a great sign for the future. I was able to let my winners run so long the low contract size didn't seem to matter as my pnl went up handedly despite. I used the MACD but not rigidly, and employed the use of stop losses in the russell to prevent the whipsaws (however if i hadn't stopped out of some of those trades they would have proved to be BIG winners as well.)

Conclusion:

Good recovery from yesterday and certainly a boost to the confidence. Tommorow feel confident with the larger lot size but watch out and remember the problems from Monday. Pay attention to the 5 minute MACD line not the histogram and trade confidently off that. Watch natty gas for the EIA at 9:30 and pay particular attention to the election which should have an affect on the Russell.

Good Luck and Namaste!

0 Comments:

Post a Comment

<< Home