Dems Take It and Rumsfield Gives It Up to an Aggie

QN/ER2

Background:

Today was the day after the midterm elections. Last night the Democrats took over the house and around 3 o'clock it was confirmed that the Democrats were no longer the minority in the Senate. In addition around lunch time, Donald Rumsfield (who was blamed for much of the Iraq war dibocal) resigned as Secretary of Defense. In his place will be Bob Gates former CIA Director and President of Texas A&M! Whhaaaaa? Yes folks an aggie. All those years growing up making fun of the aggies and well, lets just hope silent black helocopters start following me around. In any case, Nat gase sold off after the EIA, showed increased crude and decreased distillates. Around 11 the volume and volatility dried up due to anticipation of tommorow's nat gas EIA number. We hit the high point for the day at 8 dollars and finished around 7.86, trading was pretty light.

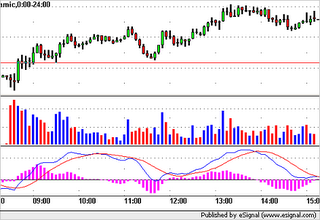

In the russell the market gapped down and pretty much ran up all day closing up around 2 dollars at 773.2. The initial 30 minutes were whipsaw-tastic, the MACD stayed positive all day which would've been a great trade early. I have found that the MACD histogram is not very reliable in the russell yet the MACD itself is very reliable. Ryan seems to believe that the russel is on it's way to 800 by Friday due to the immense buying on the down candlesticks.

Trades:

I didn't make too many trades today. I just didn't see a lot of good opportunities. I did manage to hop in on the down move in Nat Gas. Turned out to be a 1.5% winner (with only a 2 lot!!). Trouble was there were many trades that ended up getting stopped out so I ended the day only up around .25%. Not a good day by any standards, but certainly a far cry better than Mondays pit o' destruction. Something to note in the future for Nat Gas on Wednesdays, volatility really dries up after 11 o'clock. Avoid trading during this time, most moves will be fake outs.

Negatives:

I had one trade today I really wish I hadn't of done and that was just alluded to. The MACD crossed the centerline down on nat gas around 12:00 and I shorted only to get stopped out for a .75% loser. I should have noticed the decreasing volume and stayed out but hindsight is 20/20. I'll know in the future.

Positives:

Great job with risk reward today. That 2 lot trade that made around 1.5% was awesome. I let it run and at one point the trade was up around 2.5%, I was going to let it run as long as it wanted to but I was down .5% going into the trade so I put a stop where I would be up around 1%. It was good I stopped out because the market completely flipped around and I would've given it all back. Excellent job of letting the winner run and way to catch the beginning of the decline. In addition I did a little analysis and found that on average using the MACD puts us in the risk of around 10 ticks in the natty gas contract (5 cents) and 14 ticks in the russell. It is appropriate risk reward wise to use 3 or 4 contracts at the very most. My instincts on that were great.

Conclusion:

Hopefully tommorow shows a little more volatility. Use 3 lots instead of 2 lots tommorow with full confidence and continue to show great risk reward and discipline. Watch for the natty eia at 9:30 and look for rallys in the russell to Ryan's mystical 800. Great job today, the pnl didn't show the discipline involved today.

Good luck and Namaste

0 Comments:

Post a Comment

<< Home